One of the most frequently asked questions we get from women as they prepare to launch their business is, “How can I fund my business until I have paying clients that support my financial needs?”

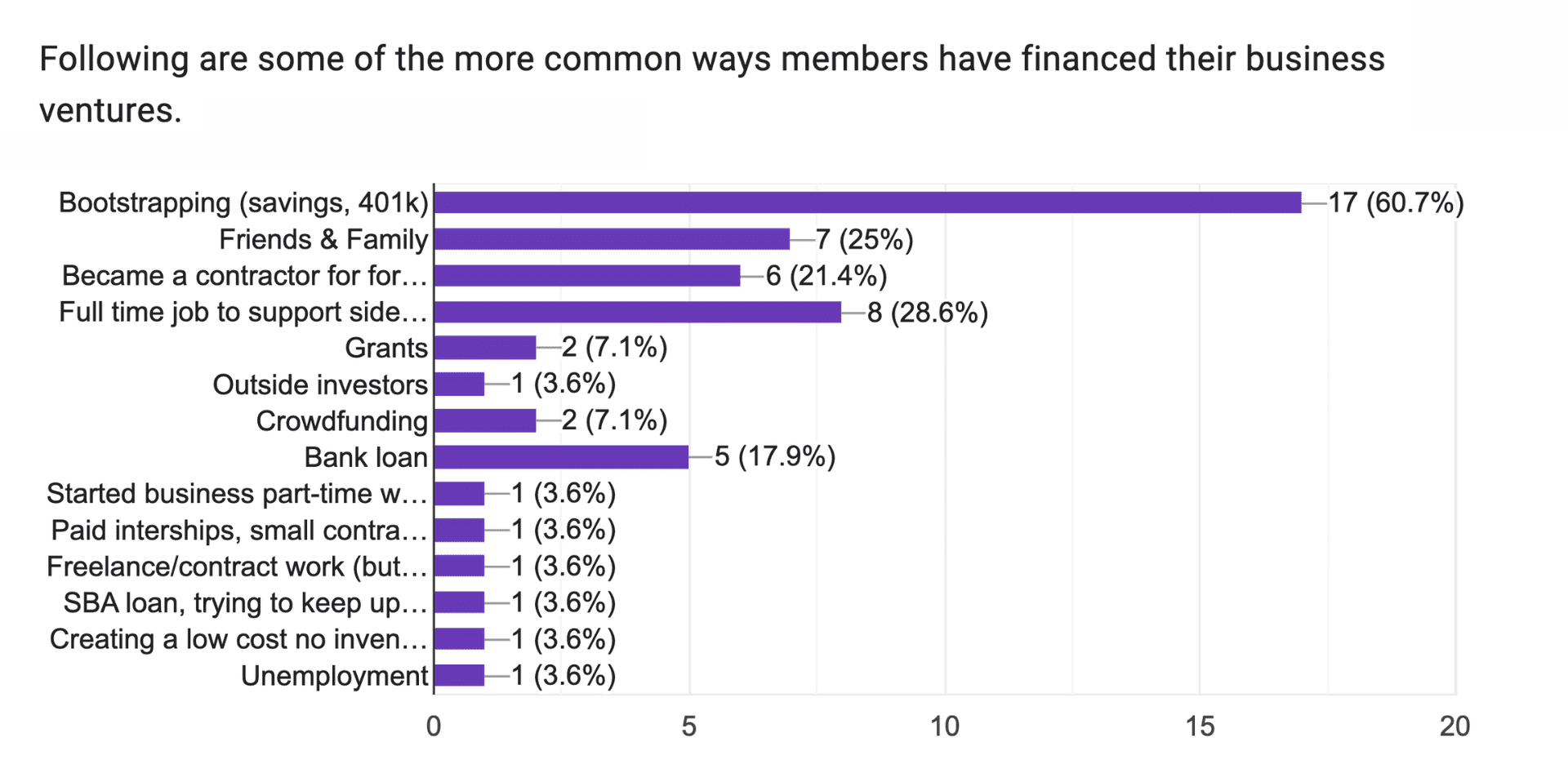

It’s such a great question, so in honor of National Women’s Small Business Month, we decided to poll our 550+ member community to learn more about how they financed the launch of their businesses. They also shared what they wish they knew when they started out! Below is a graph with their responses as well as their advice!

#1 is Bootstrapping, which is not that surprising, and #2 is starting as a side hustle!

What about you? How did you finance the start of your new business?

For more information about National Women’s Small Business Month, check out the Small Business Administration.

Darlene Hawley, Leadership & Business Coach at Darlene Hawley

Darlene Hawley, Leadership & Business Coach at Darlene Hawley

Darlene Hawley is a speaker, podcast host, business coach, and communication expert who shows ambitious, heart-centered entrepreneurs and rising business leaders how to speak up, stand out, and make more impact.

Her genius is twofold. Darlene shows entrepreneurs 2+ years into their business how to deepen their business foundation and go after visibility so they can share their message with the world, attract dream clients, and have the impact, freedom, and flexibility they desire.

Plus, she supports organizational leaders and their teams to strengthen their inner and outer voice so that they can speak up for themselves and the ideas and issues that matter most and move people to take action whenever they speak.

She is a mom of four, spouse, connector, storyteller, and dream builder based in Temecula, California. You can connect with Darlene and learn more about her speaking and coaching at darlenehawley.com.

Darlene’s startup funding advice…

Before diving into your business, take the time to create a strategic plan.

Begin by clarifying your business values, mission, and objectives, including your desired impact and financial goals.

Identify who you want to support and what problem you solve, and create a signature offer that solves your ideal client’s problems. Make financial projections to determine how many signature offers you must sell monthly to reach your goal.

A well-thought-out plan can serve as a roadmap for your business’s success.

Starting a business can be challenging, and success often requires determination, adaptability, and a willingness to learn from successes and failures.

Surround yourself with a supportive network (like Hera Hub), hire a coach or mentor who is further along in the journey than you are and continuously educate yourself about your industry to increase your chances of building a successful business.

Ursula Garrett, CEO at Garrett & Associates CPA

Ursula Garrett, CEO at Garrett & Associates CPA

Business advisor Ursula Garrett helps entrepreneurs build empires one asset at a time. She has developed expertise in business and taxes over 20+ years working with business owners and entrepreneurs to start and grow their business. Subscribe to her free email tax and business tips of the week at www.cpagarrett.com.

Ursula’s startup funding advice…

When you think you have enough money to start, double it!

Erika Bugaj, Director at Dandelion Counseling & Care

Erika Bugaj, Director at Dandelion Counseling & Care

Erika Bugaj an experienced clinical social worker and psychotherapist licensed and practicing in Washington, DC, Maryland, Virginia, New York (telehealth) and Florida (telehealth). She is the founder, director and a practicing psychotherapist at her group psychotherapy practice, Dandelion Counseling & Care. Most recently, Erika obtained the Perinatal Mental Health Credential (PMH-C) through Postpartum Support International, which reflects her professional commitment to parents’ perinatal and postpartum mental health. Erika completed the Child and Adolescent Psychotherapy Training Program at the Washington School of Psychiatry in 2013, which is a two year postgraduate certificate program for mental health professionals specializing in providing therapy with children, teens, and families.

Erika’s startup funding advice…

Get a CPA and Quickbooks

Alex Suchman, Cofounder and CEO at Barometer XP

Alex Suchman, Cofounder and CEO at Barometer XP

Alex’s mission is to make work a source of genuine meaning and connection for everyone. She uses games and play with her clients toward various learning and development outcomes in order to build thriving team cultures.

Alex’s startup funding advice…

Just how long it takes to figure out the right marketing channels and strategy, and to build the right relationships that will eventually turn into business. Markets and sales are WAY more complicated than I initially understood when I first started my business!

Liz Whitehead, CEO at 12PointFive

Liz Whitehead, CEO at 12PointFive

Liz Whitehead is the CEO of Diversity Masterminds® and 12PointFive. Liz is a business development consultant that guides business owners so they can leverage supplier diversity networks, have more productive conversations, and win new business.

She offers options for busy business owners to strategically leverage these networks: Disability:IN, NGLCC, WBENC, and NMSDC and now B Corp.

Liz’s startup funding advice…

Hello Alice is a great resource for service businesses, restaurant businesses, etc.

August Belt, Founder/President at ARB MindfulArts Corp

August Belt, Founder/President at ARB MindfulArts Corp

August Belt, 26yr old , Washington DC native , (she/her) is a First Gen Entrepreneur and College student attending Trinity Washington University Majoring in Psychology SPS. She is the Founder/President of Non-profit Expressive Therapy Youth Enrichment Org “ARB MindfulArts Corp” providing a safe space for youth and adolescent to gain or regain their voice. She is known to be Sociable, Industrious, Ambitious, Consistent and an Introverted Individual. She highly values generosity, honesty, learning and service to others.

August’s startup funding advice…

It’s best to apply for grants in Washington DC after 1 year of service and ensure you have all licenses and documentation needed. It’s also best to save or fundraise a generous amount before starting your business as it can become costly.

Theresa Wells, Integrative Health & Performance Coach at Tone At Home Fitness

Theresa Wells, Integrative Health & Performance Coach at Tone At Home Fitness

Theresa Wells is an Integrative Health & Performance Coach and an advocate in the health and fitness industry. Providing services in the areas of personal training, nutrition coaching and athletic conditioning and private and online marathon training programs. She also provides online courses centered around self-care (mental, physical, emotional and behavioral health).

She firmly believes in an alternative healing, holistic health and whole person approach. She merged her over 20 years experience in school based counseling and physical health with her vast knowledge in the fitness industry; in order to create a realistic, results based, appropriate approach in which to help the Tone At Home Fitness family flourish in living successfully fit lives.

Theresa’s startup funding advice…

Applying for grants that are specific to my business, surrounding myself with other business owners and mentors in the health, fitness and wellness industry. I would have known how to leverage my money, price my services for ROI and scaling. Having the additional business income to hire VAs to handle the behind the scenes, non money making operations: website building, IT, marketing and advertising. Having an administrative Assitant to make my folow up calls and keep me organized.

Katie Green PsyD (c), Founder + Neurodivergent Consultant Advocate Educator at Hope Reignited Consulting

Katie Green PsyD (c), Founder + Neurodivergent Consultant Advocate Educator at Hope Reignited Consulting

As a neurodivergent mental health consultant and PsyD candidate, she equip business leaders of multiple industries with a framework for how to onboard, retain, and safeguard their relationships with neurodivergent staff and clients. Individual services are focused on empowering, educating, and equipping neurodivergent women to create a life they do not need to escape from and live in a way that honors how their brain works. Everywhere she go she confidently combine her extensive psychology education, clinical background as an addiction counselor, and lived experience as an Autistic woman in every facet of her professional life. Being diagnosed Autistic as an adult has given her invaluable insights to discuss topics related to neurodiversity as it relates to DEI (Diversity, Equity, and Inclusion) efforts in the workplace.

Katie’s startup funding advice…

How to have separate business and personal finance when you don’t know how to approach a bank for a business account.

Diana Shanley, Life Coach at Diana Shanley, Inc.

Diana Shanley, Life Coach at Diana Shanley, Inc.

Diana Shanley is a vivacious life coach and mom of 2 young boys who went from operating on autopilot and overwhelm to embracing gratitude and joy to call in success, abundance, and love. She coaches other women on how to step out of survival mode and into a life they enjoy waking up to each morning by tapping into the power of play. You can start with a complimentary coaching consultation by going to www.dianashanley.com or connecting with her on Instagram at @diana.shanley.

Diana’s startup funding advice…

Debt isn’t always the enemy, be willing to invest in yourself.

Maddie Mackey, CEO + Founder at Media On The Rise

Maddie Mackey, CEO + Founder at Media On The Rise

Maddie is passionate about helping people shine. Through her media agency , her personal life, her role as a mom and her time volunteering she aims to bring the best out of those around her. She loves watching people light up when they overcome something large, accomplish a big goal or set out on a new adventure. Her people skills compliment her media super powers!

Maddie and her team bring together a vast amount of skills to support and serve entrepreneurs, of all kinds. As individuals who have worked directly in the mental health field, The Media On The Rise Team understands the importance of marketing from an honest place and remaining in integrity.

Maddie’s startup funding advice…

I wish I had known how much easier it was to run a business when I had committed income and consistent income vs trying to stay afloat. Once I took the time to secure the necessary income I needed I finally relaxed enough o make money and let my business grow for what it was and not because I NEEDED it. I am not in the phase of “crave to save” now that I am a mother and am older. I love finding ways to save and watch my. business funds GROW exponentially.

Erika Rodriguez, Founder & CEO at Nadi Marketing

Erika Rodriguez, Founder & CEO at Nadi Marketing

Erika Rodriguez is the Founder & CEO of Nadi Marketing, Tidal Pages, and The Ecosystem. She is a sustainable marketing consultant helping conscious small- and medium-sized businesses with content strategy and partnership marketing.

Erika’s startup funding advice…

You can get creative with fundraising, I was tied to digital as I launched my business during the pandemic in May 2020, but I hosted an online business shower. I created a business shower landing page which had an introduction video of what I was building and a registry that included things that I needed for my business, such as standing desk, ergonomic desk chair, 1-year Zoom membership, business books, and more! It was pretty successful and showed me how much support I had during that isolating time.

Laura Roden, Owner at Graphic Assist

Laura Roden, Owner at Graphic Assist

Graphic designer, brand expert, and marketing strategist who assists nonprofits and foundations who want to go from unpolished to professional. Drawing on 15 years of experience working with brands like Hasbro, Disney, and Nickelodeon, Laura creates strategic assets like logos, brand colors, and fonts to help nonprofits and foundations improve their brand awareness.

Laura’s startup funding advice…

Ask for MORE money. They can always say no!

Katherine Wichmann Zacharias, CEO at KSWZ Insurance Services

Katherine Wichmann Zacharias, CEO at KSWZ Insurance Services

Katherine Sai Wichmann Zacharias is a licensed insurance agent who provides a hat trick of services – bundling life insurance, long term care insurance, and tax free retirement all in one plan at a lower price. She provides unbiased, personalized financial advice and solutions that enable her clients to achieve their financial goals.

Katherine’s startup funding advice…

I had shared with me exactly what I Needed to hear and they were correct.